Chargebacks vs Refunds

Absolutely—here’s a concise, informative blog post on Chargebacks vs Refunds, including clear examples and process explanations:

Chargebacks vs Refunds: What’s the Difference and Why It Matters

In the world of payments, chargebacks and refunds are both ways for a customer to get their money back—but the processes, triggers, and implications are very different. Understanding the distinction is essential for merchants, acquirers, and anyone building in the payments space.

What Is a Refund?

A refund is initiated by the merchant. It’s a voluntary return of funds to the customer, usually because of a return, a complaint, or a service issue.

Example:

A customer buys a pair of shoes online but receives the wrong size. They contact the merchant, return the item, and the merchant issues a refund directly back to the customer’s card or account.

Process:

Customer contacts merchant Merchant approves and initiates the refund Funds are returned (typically within a few business days)

Key Points:

Merchant-driven Often faster and lower cost Can help avoid escalations or disputes

What Is a Chargeback?

A chargeback is initiated by the cardholder through their bank (the issuer). It’s essentially a forced refund, where the bank pulls the funds from the merchant’s account and returns them to the customer, often because the customer believes there’s been fraud or they didn’t receive what they paid for.

Example:

A customer sees a charge on their credit card they don’t recognize and reports it to their bank. The bank investigates and files a chargeback. If the merchant can’t prove the charge was valid, the customer gets their money back and the merchant loses the funds.

Process:

Customer disputes the transaction with their bank Bank initiates chargeback through the card network Merchant is notified and can respond with evidence Issuer makes a final decision

Key Points:

Issuer-driven Can be costly (fees, lost revenue, operational time) Impacts merchant’s chargeback ratio (important for risk monitoring)

Refunds Help Prevent Chargebacks

Whenever possible, it’s best to resolve customer complaints directly and issue refunds proactively. Chargebacks can be messy, time-consuming, and damaging to merchant reputations.

Pro tip: Clear communication, easy-to-use return policies, and transparent billing descriptions help reduce the risk of chargebacks.

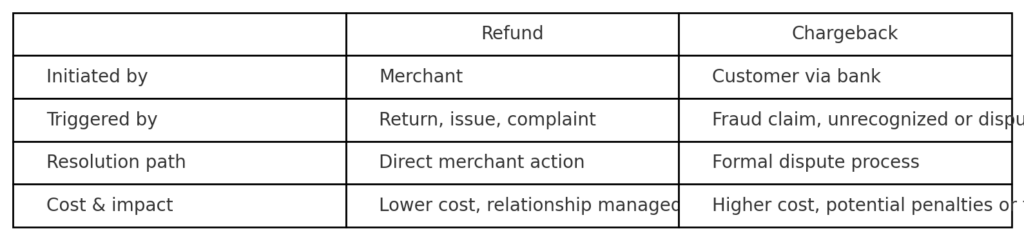

Summary:

Want to go deeper? In an upcoming post, I’ll walk through the lifecycle of a chargeback, including timeframes and evidence requirements.